Chesapeake Energy?s (CHK) recent deal to sell its Appalachian Midstream Services, LLC, for $865 million to its spin off, Chesapeake Midstream Partners, LP (CHKM), may seem like hand waving to some. However, it is not.

Chesapeake Energy?s (CHK) recent deal to sell its Appalachian Midstream Services, LLC, for $865 million to its spin off, Chesapeake Midstream Partners, LP (CHKM), may seem like hand waving to some. However, it is not.

Via this deal CHK has transferred debt obligations to an independent subsidiary, and it has gained a greater interest in the subsidiary. The publicly owned subsidiary has then taken on this debt load. This all means that CHK cannot be held liable for it. Plus the near monopoly pipeline business, CHKM, can borrow the money to finance this debt on good terms because it has a steady and defined income stream from its pipeline operations. Banks don?t like the big morass that is CHK any more than the analysts. It is too hard for them to determine what might fail and what effects any failure(s) might have on the overall company. With this action CHK has seemingly become more complex, but in actuality has become less complex to the bankers. This is a good thing. It should help CHK?s debt rating.

In another recent JV deal, CHK sold a 25% interest in 570,000 acres of CHK?s Utica Shale holdings to an undisclosed partner for $2.1B. $500M is scheduled to be paid by year-end 2011, and the remaining amount will be paid as development expenses in the Utica by 2014. This amounted to selling 142,500 net acres of its Utica lease holdings for a price near $15,000 per acre. This is nearly $12,500 per acre more than CHK paid for those acres ($2500/acre). This new money will allow CHK to fund some of its Utica development expenses. Plus it will pay off some of the debt incurred in buying the Utica lease holdings. It means CHK effectively bought roughly 700,000 of its Utica acres for free.

At the same time CHK formed a subsidiary for another part of its Utica Shale holdings. It sold $1.25B in perpetual preferred shares in this subsidiary, CHK Utica LLC, to EIG Global Energy Partners, GSO Capital Partners LP, and Magnetar Capital. This subsidiary owns approximately 700,000 net acres in the Utica. With this action CHK acquired $1.25B in immediate cash. Plus it sold no common shares in CHK Utica LLC, so it has retained complete control. In other words, CHK still owns those 700,00 acres. It has acquired the burden of the dividend payments for the preferred shares, but that is a lesser burden than its former debt. If CHK Utica LLC (CHKU) becomes cash strapped, it does not have to make dividend payments on time, although those payments will accumulate. The possibility of default is lessened considerably.

Effectively, CHK has moved development costs and debt burden into CHKU. This again decreases the liability of the parent company, but it does not really decrease its potential gains. Plus it again makes CHKU more understandable as a ?more simple entity? to banks. It makes CHKU more able to obtain favorable bank loans. Perpetual preferred shares have no maturity date, and they can be called at any time by the issuer (CHKU).

Analysts are going to soon realize that far from complicating the financial structure of CHK, this action (and others like it) simplify CHK?s financial structure to a banker. Plus they help to increase the book value of CHK?s assets, which again makes CHK a better overall credit risk. Since few now doubt the commercial viability of CHK?s Utica Shale holdings, this is even more true.

Some of the other ?monetization? actions CHK has taken just in the last year are:

- It closed a JV with CNOOC (CEO) in the DJ and Powder River Basins for approximately $1.3B of cash and drilling carries in February 2011.

- It closed the sale of Fayetteville Shale assets for net proceeds of approximately $4.65B in cash to a subsidiary of BHP Billiton Ltd. (BHP) in March 2011.

- It repurchased approximately $2B in senior notes and contingent convertible senior notes YTD.

- It closed VPP 9 proceeds of approximately $850M for approximately 180 bcfe of proved reserves for approximately $4.82/mcfe in May 2011.

- It helped develop a recapitalization plan for Frac Tech Services LLC. It received a cash distribution of approximately $200M, and it now owns 30% of Frac Tech?s common stock, which has a $100 cost basis.

- It is working on more monetizations.

- Its growth projections were so strong in the first six months of the ?25/25 Plan" it amended the plan to a ?30/25 Plan? (30% production growth per year and 25% reduction of long term debt per year).

Along with the $2.1B and $1.25B deals described in detail above, these actions amount to a total of more than $10B. This is more than half of CHK?s market cap of $14.54B. It is approximately one third of its $27.22B Enterprise Value. This is huge, and it shows CHK?s true value. CHK lost very little overall in these deals, but it gained huge amounts of cash. CHK still has 15.1 million net acres in excellent oil and gas fields. 6.1 million net acres of these are in prime oil shale fields.

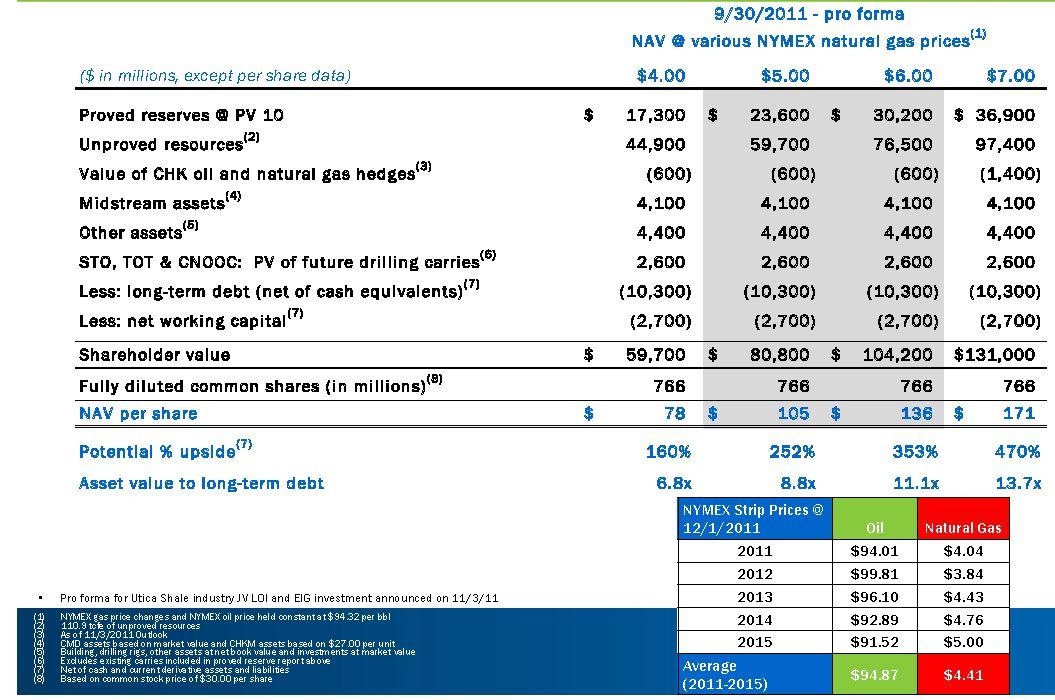

Huge amounts of CHK?s assets are extremely undervalued, as the above deals show. The sale of the Utica assets (acquired for $2,500/acre) for approximately $15,000 per acre is an example of just how undervalued many of these assets are on the books. CHK has prepared a NAV table analysis (see below), which attempts to estimate the true value of CHK?s assets. However, even this table far undervalues the assets. It does not come close to putting a ?real? value on CHK?s oil shale assets, and it only touches on the possible natural gas assets' ?real? value.

More and more world long term energy forecasts are predicting huge increases in natural gas use. This means huge increases in natural gas prices. A lot are predicting these increases will begin in 2012 as the U.S. finally begins to recognize the potential price gains from exporting LNG. There is also the possibility of a U.S. energy policy change that will emphasize natural gas use for transportation.

Click to enlarge

CHK sells at a PE of 11.4 and an FPE of 9.49. It pays a non-negligible dividend of 1.50%. There is a lot to like in this stock. I will try to follow up with a second article about its production progress. However, any serious investor should be looking at this stock for a long-term investment. If it has another $5B-$10B debt monetization year in 2012, that may really put it on analysts' radar. You will want to be in this stock at that time.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in CHK over the next 72 hours.

celtics braylon edwards jimmer fredette mall of america mennonite gordon hayward smokey robinson

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.